Fundraising: Donation Options

Every single donation makes a difference in the life of a person living with dementia. Donations can be directed to supporting services in our local regions: Brantford & Brant County, Haldimand Norfolk, Hamilton and Halton.

How to Give:

- Online

- Phone

- Mail a cheque (make payable to Alzheimer Society Foundation)

- E-transfer

- In-Person

Online Printable Donation Form E-Transfer Form Office Locations

Our monthly giving program is a convenient way to support the Alzheimer Society. A small monthly donation may not seem like much, but it all adds up to help those affected by Alzheimer’s disease and other dementias. You can join for as little as $10 a month – just 33 cents a day!

Why give monthly?

Bigger Impact – Monthly donations are one of the most cost-effective and environmentally friendly ways to give; this means we can spend less time and money on administration and more on what matters.

Build it into your monthly budget – You can divide your annual donation into twelve equal payments and know that your gift works each month to support a cause you believe in.

Preparing for the Future – A regular and predictable source of income provides stability in program planning and allows us to prepare for the needs of tomorrow.

Tribute donation are a meaningful way to pay tribute to a loved one, mark a special occasion or express your sympathy.

In Honour giving

You can donate to pay tribute to a loved one and select from a variety of e-card designs when you make your gift online.

In honour gifts are appropriate for many occasions including:

Anniversary

Wedding

Birthday

Seasonal Greetings

Workplace Achievement

Retirement

In Memoriam giving

You can donate to express your sympathy for the loss of a loved one. You may make your donation online and select from a variety of e-card designs.

We are extremely grateful to the families who choose the Alzheimer Society Foundation of Brant, Haldimand Norfolk, Hamilton Halton as their charity of choice when honouring the life of their loved one. Families that choose to host a Celebration of Life may contact their local office for a supply of In Memoriam cards.

Leaving a legacy gift ensures that people living with dementia and their care partners will have strong reliable supports available to them throughout their dementia journey.

When you leave a legacy gift to the Alzheimer Society, you help sustain our community services including dementia education, counselling & support groups, and health & wellness activities.

Legacy gifts can take many forms; a will bequest, gift of securities, RRSP/RRIF or life insurance policy.

Each of these options allows you to direct as much money as possible to your benefactors and to charity. The Alzheimer Society recommends you seek legal and financial planning advice when making such a gift.

Legacy gifts can be given to Alzheimer Society Foundation of Brant, Haldimand Norfolk, Hamilton Halton. The charitable registration number is 89453 7984 RR0001

Estate Planning Guide

Estate Planner

Request a FREE Estate Planning Toolkit

You can learn more about the impact of a legacy by visiting Will Power’s website, Will Power is a national public education campaign designed to inspire Canadians to think differently about charitable giving and empower them to create positive change through their Wills.

You may contact Aileen Bradshaw to discuss your legacy gift at 1-800-565-4614 ext 515 or aileen.bradshaw@alzda.ca

Donate your vehicle to support the Alzheimer Society of Brant, Haldimand Norfolk, Hamilton Halton!

When you donate your RV, boat, motorcycle, or other vehicle it will either be recycled or sold at auction depending on its condition, age and location.

Donate-a-Car Canada will look after all the arrangements. They will forward us the proceeds of your vehicle donation and receipt.

Learn more at Donate-a-Car Canada.

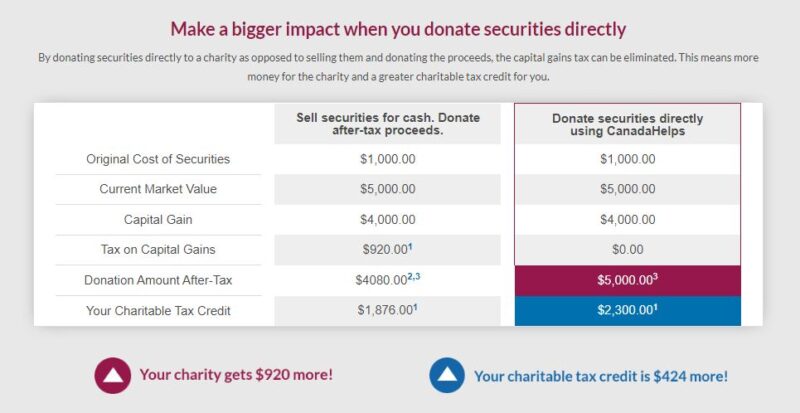

A donation of publicly traded securities is one of the easiest and most effective ways you can support the Alzheimer Society Foundation of Brant, Haldimand Norfolk, Hamilton Halton. And you can avoid the capital gains tax that you would normally have to pay if you sold the securities and then donated the proceeds.

The Alzheimer Society will issue you a charitable tax receipt for the fair market value of the security on the date of transfer into our brokerage account. You can donate securities now or as part of your estate planning.

When you donate securities in-kind, you may benefit from the elimination of the capital gain accrued on the securities plus the donation tax credit. As such, it may cost you less to make a donation of securities than a donation of cash.

If you plan on making a donation, have your financial advisor review your portfolio to determine if there are any securities with large capital gains. Attached is the Transfer Intent Form to give to your financial advisor with the information you need to transfer stocks to the Alzheimer Society Foundation.

Printable Letter of Intent doc

Printable Letter of Intent PDF

To explore the benefits of this type of giving, please contact Aileen Bradshaw at aileen.bradshaw@alzda.ca or by phone at 1-800-565-4614